How to Identify Profitable Real Estate Markets in Gurgaon

Gurugram (formerly Gurgaon) has transformed into a high-tech satellite city of Delhi with a glitzy skyline and booming real estate. Its strategic location on NH-48 (Delhi–Mumbai Expressway) and proximity (just 4 km) to the international airport make it a magnet for IT firms, BPOs, and multinational headquarters. The Gurgaon property market 2025 is shaped by surging demand along new infrastructure corridors and strong rental growth in commercial hubs, making it one of the most profitable real estate markets in North India. Long-term investors are closely studying infrastructure and master plans: for instance, new growth corridors like the Dwarka Expressway and Southern Peripheral Road (SPR) have recorded explosive price gains recently. Meanwhile, well-established sectors near Cyber City and Golf Course Road continue to command premium rents. This unique blend of mature and emerging nodes creates a diverse spectrum of investment opportunities for both residential and commercial buyers.

Gurgaon Real Estate Overview (2025)

Gurugram’s growth is driven by new highways, metro lines and business parks. Investors entering in 2025 find a market that has just shrugged off pandemic lulls and is back in strong upward mode. For example, prices along the Dwarka Expressway corridor nearly doubled from ₹9,400 to ₹18,700 per sq. ft. in 2020–24. Similarly, major SPR sectors have seen 5-year gains from ₹7,700 to ₹18,000 per sq. ft. In the first half of 2025, experts note residential prices in NCR jumped 27% driven by a boom in luxury and ultra-luxury housing. Luxury launches now account for 82% of new supply, pushing average home prices higher. So far sales remain healthy (booking cancellations are under 5%), suggesting demand from end-users and long-term investors.

- Current Opportunities: 2025 hotspots include Dwarka Expressway, Southern Peripheral Road (SPR) sectors 76–77, Golf Course Extension Road and improved Sohna Road. These corridors offer a mix of luxury and mid-market projects, often with planned smart-city amenities. Established enclaves (Cyber City, Golf Course Road) still give steady leasing yields and strong capital growth. In all cases, proximity to employment nodes (offices, IT parks, factories) underpins rental demand.;

- Rental Trends: Cyber City and Golf Course Road office rents remain among India’s highest (premium office space). For instance, premium office rents average ₹2,000–2,500/sq. ft. per month in Gurugram. Residential rents vary: luxury apartments near corporate hubs yield 2–3%, while studios in older parts may fetch slightly higher yield. By contrast, commercial properties in Gurugram typically yield 5–9% and appreciate 7–10% annually, far outpacing residential yields (2–3%). Gurgaon also boasts strong absorption – e.g. 16,502 of 15,994 new units along Dwarka Expressway (2020–24) were sold, and another 18,000 units are slated for launch by 2030.

- Investor Outlook: Analysts predict continued appreciation. On Dwarka Expressway alone, major players expect 40–60% price growth over the next 5 years as new infrastructure (toll road, metro) comes online. Smartly chosen Gurgaon locations have one of the highest appreciation rates in India. Unchecked luxury supply could create a short-term overhang, but solid developer credibility (RERA enforcement) and low cancellation rates suggest a balanced cycle.

Key Location Factors & Infrastructure

In Gurgaon, location rules value. Profitable sites cluster near transit, highways and planned townships. Key factors include:

- Road Connectivity: Gurugram is crisscrossed by major highways. The Dwarka Expressway (NH-248A) now provides a direct 27.6 km link between Delhi (Kherki Daula) and the airport area, relieving NH-48 congestion. An inner 16‑lane Northern Peripheral Road is also planned. The Southern Peripheral Road (SPR) links Gurgaon-Faridabad Road to NH-48; SPR has become the city’s most active new corridor. Other planned arterial roads under the Master Plan 2031 include a 150m-wide link from Delhi’s Dwarka to Gurugram and a 90m link to Sohna Road. These expand access to peripheral zones and ease logistics, rapidly boosting land prices along their routes.

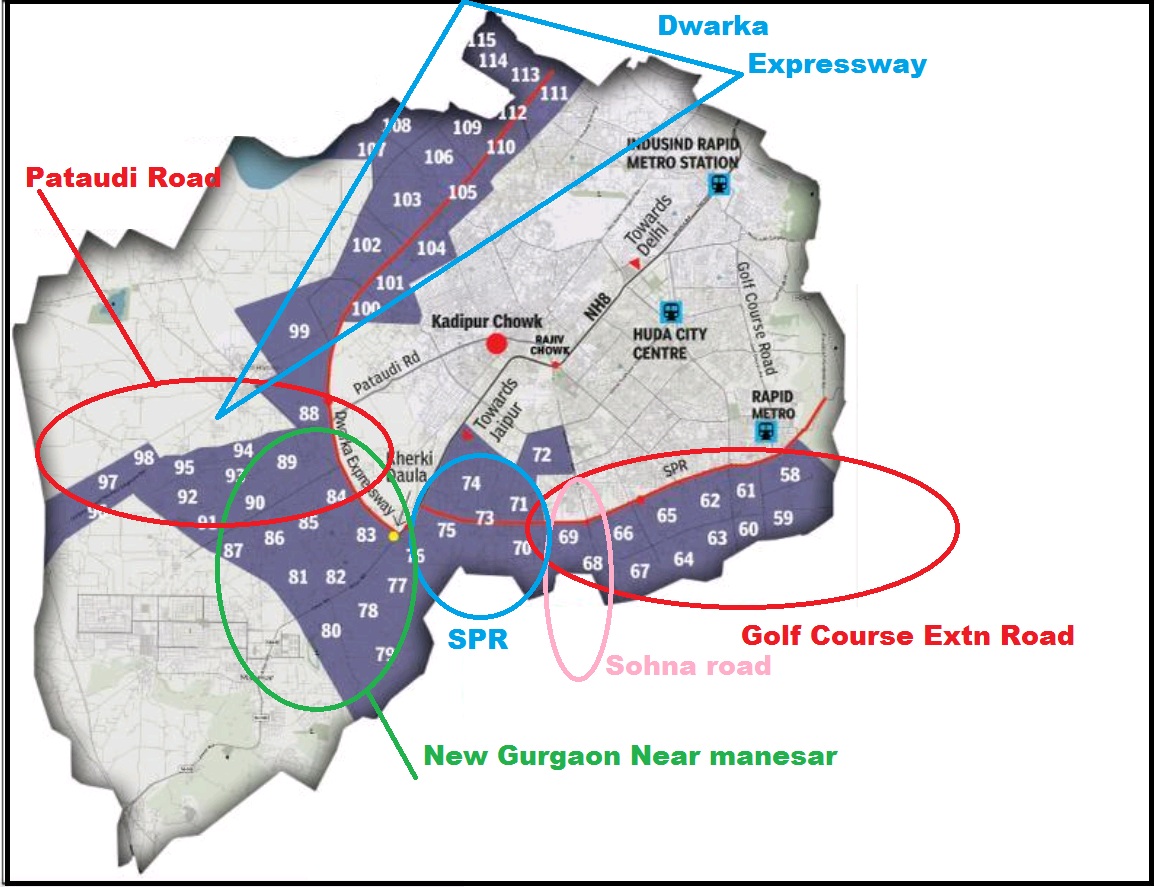

Profitable Real Estate Markets, Gurgaon Master Plan 2031 Real Estate

- Metro & Transit: Metro extensions are a game-changer. Gurugram’s Yellow Line currently ends at HUDA City Centre, but plans call to extend it via new loops through Golf Course Road to SPR and to Manesar. The Delhi-Alwar RRTS (Regional Rapid Transit) line, under construction, will pass through Gurugram (Cyber City) and connect to Delhi, slashing commute times. Such projects greatly improve mobility and draw interest. (For example, Gurugram’s Rapid Metro and Sohna Elevated Corridor already raised office area values.)

- Proximity to Air & Cities: Gurgaon is 15–20 min from IGI Airport and 30 min from central Delhi via NH-48/Yellow Line. NH-8 delivers direct access to Rajasthan (Jaipur) and Mumbai corridor. Upcoming projects like a new INR 11,000-cr “Global City” (logistics park) and an elevated Gurgaon-Faridabad Corridor will strengthen connections to Faridabad and the new Jewar airport.

- Master Plan & Zoning: The Gurgaon–Manesar Urban Complex (GMUC) Master Plan 2031 shapes growth. It designates large tracts for IT/SEZ, commercial, residential and utilities. For example, sectors 37D, 99A, 100–107 (608 ha) are reserved for public utilities, while 2027 ha is allocated for public/institutional uses (including a 215-ha planned university in Sector 68). The plan ensures that new zones (like Dwarka Exp corridor, SPR belt, Manesar) have road & transit access. In practical terms, this means developments in master-plan-aligned corridors (Dwarka Exp, SPR, Sohna Road, NH-8) enjoy official support and scaling amenities.

Bottom Line: For investors, the infrastructure roadmap is a blueprint. Locations intersecting major roads or Metro/RRTS stations have outsized upside. For example, being on the completed Dwarka Expressway or a future Metro line is a huge positive. One developer note: “When people buy a home, location is the crucial factor”. Indeed, land values in SPR sectors have risen sharply due to new flyovers and road widening. Similarly, planned connections (e.g. the 150m Dwarka link) under the Master Plan promise to open up fresh land inventory. In summary, factor in the Master Plan’s vision, existing highways/metro lines, and upcoming transit projects when choosing micro-markets. These location advantages translate directly to demand and return.

Top Micro-Markets in Gurgaon

Real-estate returns vary greatly by micro-market. The current hotspots (and their location premiums) include:

- Dwarka Expressway Corridor (Northern Gurgaon): A premier high-growth residential hub with excellent Delhi connectivity. Key sectors (37D, 102–106, 113) dominate new supply. Launch prices have already doubled (₹9.4k→₹18.7k in 4 years), and major launches are often sold out at ₹18–22k/ sq. ft. This corridor offers a spectrum from 2–4BHK apartments to gated villas. Analysts forecast 40–60% appreciation by 2030 here thanks to the operational expressway and a planned Metro. Demand is driven by commuters working in Delhi and Gurugram (e.g. Cyber City). Rental yields are moderate (2% on high prices) but attractive for end-users. In short: high capital gain potential but relatively low initial yields.

- Southern Peripheral Road (SPR), Sectors 76–77: Rapidly emerging as “New Golf Course Road”. SPR links Bad Shahpur road to NH-48 and lies near evolving corporate campuses (Amex, TCS, etc.). Luxury projects by DLF and others sold out fast (DLF Privana South sold 1,113 units for ₹7,200 cr in 72 hours). These sectors offer newer mid-to -high-end apartments with modern amenities. Developers note sustained sales momentum since 2021. With more developers launching (Signature Global, M3M, Emaar), SPR remains the most active Gurugram micro-market. Rental yields are moderate as projects cater to owner-occupiers, but solid ROI is seen from quick price jumps (one 2023 launch saw 64% gain in <2 years).

- Golf Course Extension Road: A mature luxury corridor connecting Golf Course Road to South City 1. It has top-brand projects (DLF, M3M, Adani) and premium social infrastructure (schools, hospitals, malls). Recent launches (e.g. DLF’s ₹18k/sqft Arbour, Adani’s “Amaryllis”) sold out quickly. Golf Course Ext. attracts NRIs and upscale buyers seeking high rental yields on premium apartments (5–6% yield on furnished units is common). The area’s strength is established amenities and a metro extension under construction. Expect steady 7–10% annual appreciation here, albeit from a high base.

- Sector 80–95 (New Gurgaon): This is Gurugram’s new town along NH-8 beyond Bad Shahpur. It includes emerging pockets like Sector 80 and Dwarka Expressway’s tail end. These sectors offer comparatively affordable mid-segment projects and are benefiting from highway frontage. Sobha reports sectors 80–95 and Dwarka Exp among the highest ROI zones in 2025. For example, Sector 85 saw 28% price growth in 2024. With new highways and approvals, these areas are emerging investment bets.

- Sohna Road Corridor: Southern Gurugram’s established corridor to Manesar. Offers mid-range housing (sectors 49–67) and much commercial/IT space (Sohna Hills, DLF Cybercity). Newer sectors (82–95) are being developed as spillover from SPR growth. Commercial offices along Sohna (e.g. vicinity of Golf Course Ext.) fetch high rents (rentals ₹2k/sq. ft.) due to proximity to Gurgaon’s IT belt.

- Central Business Districts (Commercial Clusters): Beyond housing markets, consider Gurgaon’s office and retail hubs. Areas like Cyber City, Golf Course Road, MG Road and Udyog Vihar consistently fill high-grade office space. Commercial vacancies are low (<10%) and annual capital appreciation 8–10%. Even if land prices in these mature zones have plateaued, stable rental yields (5–7%) and lease terms make them profitable. Retail clusters (e.g. Ambience Mall area) also command premium mall/office leases. For a commercial investment, proximity to established business parks is key.

Residential vs Commercial Trends

- Residential Market: Gurugram’s residential market is polarized. The luxury segment (4+ BHK, gated townships on Golf Ext, Dwarka Exp, SPR) has boomed post-2021, often selling fast at premium prices. Mid-tier developers are now targeting mass segments in peripheral areas. In contrast, affordable housing (below ₹40 lakh units) has seen few new launches, pushing overall prices up. Rental demand is driven by corporate influx and millennials; demand for 2–3 BHK apartments near IT parks is strongest. Typical rental yields for ready residential projects in Gurgaon hover around 2–3% of property value. This means investors must factor in long-term capital appreciation (often >7% per year) to achieve desired ROI.

- Commercial Market: Gurugram remains NCR’s commercial engine. Over 250 Fortune 500 companies have offices here. Office space absorption has been brisk. Investors in Grade-A offices and retail can expect higher yields (5–9% per annum) because of higher rents and longer leases (blue-chip tenants). Key areas like Golf Course Road, NH-8 (Cyber City), and upcoming SPR-commercial sectors ensure diversified commercial options. Typically, a good commercial investment in Gurgaon offers 6% ROI combining 7–10% capital gains plus 5–9% rental yield – well above bank FD rates. The trade-off is larger ticket sizes and longer holding periods.

- Key Differences: In summary, residential investors focus on buying early in emerging zones for capital gains (with moderate rent returns), while commercial investors value steady lease income and cap-rate stability. Gurgaon’s market today allows both: for example, a 4BHK on Golf Course Road might yield 2% rental return and 8–10% annual appreciation, versus a Cyber City office yielding 7% with 8% appreciation. Your choice depends on investment horizon and risk appetite.

Metrics and Returns (Cap Rates, ROI, Yields)

Savvy investors use financial metrics to compare locations:

- Rental Yield: Annual rent ÷ property price. In Gurgaon: high-quality commercial spaces often yield 5–9%, whereas residential apartments generally yield only 2–3%. Thus “high rental yield Gurgaon” spots are usually near employment hubs or in serviced apartments catering to NRIs/expats. For example, furnished office rentals near Cyber City can give yields up to 6–7%. For a residential buyer, even a 4% yield would be considered excellent.

- Capital Appreciation: Property price growth per annum. Prime Gurgaon corridors have seen double-digit gains recently; analysts cite 7–10% annual growth as a benchmark in good micro-markets. It’s not uncommon to see 100% appreciation in 3–4 years for emerging sectors (Sector 61 launched at ₹8k in 2021 now ₹16k). More mature areas grow slower but more predictably.

- Cap Rate (Commercial): Net operating income ÷ property value (similar to yield). In Gurugram’s office market, a 6% cap rate (7–10% growth + 5–9% rent) is strong. By comparison, residential cap rates (rental yields) of 2–3% often necessitate relying on capital gains for total ROI.

- ROI (Total Return): Combines both rent and price rise. A good Gurgaon property should beat the inflation-and-FD combo (8–11% annually). For example, if you get 3% rent yield and 7% price growth, that’s 10% ROI. Local consultants suggest 5–8% annual ROI as a rule-of-thumb for prime Gurugram locations. Indeed, growing local demand and infrastructure triggers lead some experts to project 40–60% total price growth over 5 years on corridors like Dwarka Exp.

Investors should compare yields to benchmarks. A rule from experts: commercial yields “up to 6%+” outperform residential yields (2–3%), and both should exceed fixed-deposit returns (5–6%) to be worthwhile. High vacancy or oversupply can depress these returns, so check occupancy rates and pipeline (for instance, some caution flags have been raised about unsold luxury inventory in Gurugram). In bullet form:

- Metrics to check:

- Rent Yield (%): 2–3% (residential), 5–9% (commercial).

- Price Growth (% p.a.): 7–10% in strong sectors.

- Cap Rate (office): 6% combine yield + appreciation.

- Vacancy Rate: Aim for areas with ≥90% occupancy (most CBD office parks achieve this).

- Benchmark Comparison: 6% ROI = good (beats inflation/FD).

- Premium Corridors: Dwarka Exp and SPR continue to see the fastest appreciation (double-digit annually). Established CBDs offer steadier but lower-yield returns.

Government Policies & Master Plan Influence

Government action and urban plans play a big role in Gurgaon’s investment climate:

- Master Plan 2031: This comprehensive blueprint (Gurgaon–Manesar Urban Complex) dictates zoning and infrastructure. It earmarks new road corridors (e.g. Dwarka link, Vasant Kunj-Sohna Road), transit hubs, green belts and special economic zones. For example, the plan reserves land for a transport hub (Sector 33), a major university (Sector 68, 215 ha), and a large hospital/utility zone (608 ha in Sectors 37D/99A/100+). Such designations guide developers: areas slated for IT parks or SEZs will likely see demand and policy support. Crucially, the plan’s proposed Metro loops and additional highways confirm that corridors like Dwarka Expressway and SPR are long-term growth lanes.

- Infrastructure Initiatives: Central and state projects continually boost Gurugram’s appeal. Key triggers include the completion of the Dwarka Expressway (Delhi-Gurgaon link road), expansion of Gurugram Rapid Metro, and NCR Transit plans. For instance, Haryana’s upcoming Rapid Metro expansion (May 2025) and dedicated Rapid Rail (RRTS) will greatly improve connectivity within and beyond Gurugram (facilitating commutes to Delhi in 60 min). Other state projects, like the proposed Gurgaon-Faridabad elevated corridor or an inner ring road, will shave travel times. Each new project tends to spark price jumps in nearby localities.

- Regulatory/Policy Environment: Recent reforms have made Gurugram safer for investors. RERA enforcement has curtailed fly-by-night developers by mandating project registration and timely delivery. Digitization (online approvals, property records) and transparency (title clearance) also reduce risks. The Haryana government has extended tax breaks and incentives for green or affordable projects, encouraging sustainable construction. Furthermore, central schemes (PMAY-Urban 2.0) support affordable housing in the city. These policies have re‐energized demand: Sobha Realty notes that improved regulatory confidence and ease of doing business have “boosted investor confidence in the city”.

- Location-specific Schemes: Gurugram is included in India’s Smart Cities Mission, which channels funds into urban infrastructure (Wi-Fi, smart grids, waste management). Also, NRI property buyers find Gurgaon attractive due to government ease (FEMA relaxations, 2% stamp duty for NRIs in Haryana until 2025). Municipal master plans have reserved plots for solar EV charging across new developments, reflecting progressive ordinances. In short: understanding policies helps. If a locality is designated a growth zone (like a Special Area for development), projects there tend to enjoy faster approvals and higher investor interest.

Strategic Takeaways for Investors

When identifying a profitable Gurugram micro-market, focus on “location fundamentals”:

- Connectivity & Infrastructure: Choose sectors on or near major roads and transit nodes. The impact is visible: Gurgaon’s SPR corridor (with its new highways and flyovers) has become the “region’s most active micro-market”, yielding rapid gains. The same is true for the completed Dwarka Expressway: operational status has firmly established it as a desirable residential zone.

- Master Plan Alignment: Prioritize areas earmarked for commercial/IT use or easy access in official plans. The Master Plan’s roads (e.g. 150m Dwarka link, 90m Andheria-Sohna road) signal where future development will concentrate. Investing in these corridors early can capture maximum upside.

- Micro-market Maturity: Don’t dismiss established areas. Golf Course Road and NH-8 (Cyber City) remain solid bets. They offer immediate rental income and occupancy, though with slower price growth than emerging sectors. A portfolio approach—mixing a blue-chip location with one or two high-growth fringes—can balance yield and appreciation.

- Commercial Hub Proximity: For rental yield Gurgaon, look near corporate offices and tech parks. Sectors adjacent to big companies (e.g. Cyber City, DLF Gardens, Sector 67/68 near Udyog Vihar) rent faster to professionals. Such locations may cost more per sqft but deliver a steadier rent stream (and may command higher yields in percentage terms).

- Policy Zones: Monitor government triggers. Announcements like a new expressway opening date, metro corridor approval, or special policy (like an industrial park development) will often cause a surge in local land values. For example, media reports link a 64% surge in an SPR sector to the Trump Residences announcement. Being aware of such news (and even local municipal plans) can give investors an early mover advantage.

Fig: Construction along Gurgaon’s Southern Peripheral Road (SPR) corridor. Active projects and road upgrades (e.g. widening, flyovers) have driven SPR prices from ₹7,700 (2020) to ₹18,000 per sq.ft. by 2024.

In summary, location strategy in Gurgaon boils down to infrastructure-driven growth. The highest returns have gone to buyers who aligned with the city’s evolving transport and zoning blueprint. Key SEO-friendly terms to watch in this context are “Gurgaon property market 2025,” “Dwarka Expressway investment,” and “high rental yield Gurgaon,” as these capture exactly the corridors and yields that savvy investors are seeking. Comprehensive due diligence – checking pipeline projects, yield metrics and master plans – is essential. By focusing on Gurgaon’s emerging and established growth corridors, investors can identify markets poised for both strong rental income and capital appreciation through 2030 and beyond.

Government and Long-Term Outlook (to 2030)

Looking ahead to 2030, Gurgaon’s growth drivers are clear: continued urbanization, international corporate inflows and government infrastructure will keep demand buoyant. Forecasts suggest Gurugram will further “establish itself as a leader in smart city development and sustainable urban planning” by 2030, meaning newer localities will integrate tech (IoT, VR home tours) and green design. Peripheral belts (Sohna Road, Dwarka Exp, Manesar) are expected to see the bulk of new supply. Another long-term catalyst is education: a planned mega-university (215 ha in sector 68) could spawn thousands of students and staff seeking housing.

Key growth drivers through 2030 include: continued metro/RRTS rollout, highway expansions, and policy support for affordable and green housing. For instance, a “Global City” logistics hub and an industrial park are slated for around Gurugram, which will create new jobs and boost real estate demand. Even as prices have already climbed impressively, many analysts conclude Gurugram’s fundamentals remain strong: low crime, high employment, robust infrastructure. As one developer notes, Gurgaon has “far more legs” than most cities in India.

Bottom Line: For long-term investors, Gurgaon’s location story is all about its corridors of connectivity. By 2030, corridors like the Dwarka Expressway and SPR – now on the fast track – are expected to mature into fully developed Neighbor hoods akin to today’s Golf Course Road. Smart investors will stay informed on master plan updates, government triggers, and market data (yields, new launches) for Gurgaon. The goal is to anticipate where the next hot pocket will be as the city grows. In practical terms, that means:

- Invest early in emerging corridors identified above (buying at launch phase rather than just before possession).

- Diversify between residential and commercial based on risk appetite: a small office or retail unit near Cyber City can provide higher yields, while a residential apartment in a new township provides equity growth.

- Monitor rental markets: Gurgaon’s rental demand has returned strongly post-COVID (rents in Gurugram rose 28% in Q1 2025, per [57]). Areas with high rental growth imply tight supply and strong employment.

- Stay policy-savvy: Keep an eye on Haryana’s urban plans and incentives. For instance, any extension of PMAY subsidies into Gurugram or fast-tracking of transit projects can be market-making news.

By applying these location-centric strategies and staying on top of metrics (cap rates, yields), investors can navigate Gurugram’s dynamic market and target the sub-markets most likely to deliver profitable returns.

📌 FAQs: Profitable Real Estate Markets in Gurgaon

✅ Q1. What is driving demand in the Gurgaon property market 2025?

Massive infrastructure like the Dwarka Expressway, metro extensions, and new business hubs have boosted prices and rental demand, making Gurgaon a prime choice for investors this year.

✅ Q2. Which Gurgaon areas offer the best long-term ROI?

Top picks include Dwarka Expressway investment sectors, Southern Peripheral Road (SPR), and Golf Course Extension Road, thanks to planned metro stations and master plan zoning.

✅ Q3. How much rental yield can I expect in Gurgaon?

- Residential: usually 2–3% rental yield

- Commercial: typically, 5–9% rental yield

If you want high rental yield Gurgaon properties, look near corporate hubs like Cyber City.

✅ Q4. Why is location so important for Gurgaon real estate?

Areas close to expressways, metro stations, and IT parks see faster price growth and lower vacancy, directly boosting both rental income and appreciation.

✅ Q5. Is it better to invest in residential or commercial property in Gurgaon?

Residential often gives higher price appreciation; commercial properties in Gurgaon generally deliver stronger, more stable rental yields.

✅ Q6. What does the Gurgaon Master Plan 2031 mean for investors?

It highlights future growth corridors like the Dwarka Expressway and SPR, so buying in these planned areas typically offers better ROI and sustained demand.